Market Overview & Sector-wise take !

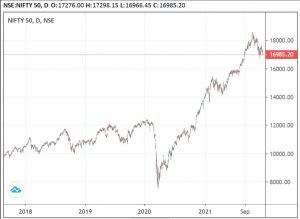

Equity markets have had a spectacular run over the last 18 months!

On the one hand this remarkable run has been driven by revival in the corporate profits. On the other, the multiple expansion has been supported by several positive factors converging together at the same time, that point to a brighter macro-outlook. Higher valuations are also supported by historically low interest rates.

However, we have been cautious as the markets peaked in the month of Oct at NIFTY 18,600, for various reasons outlined below:

- Aggregate one year forward multiple of the market at 23 was expensive, as compared to the historical average of 17. Though, lower interest rates partly account for higher multiples.

- Our expectation that earning upgrades in the third and fourth quarters of FY 22 will not only pause, but some downgrades may happen too

- We have also been conscious of the fact that rising interest rate environment may act as a significant headwind

- Possible correction in the USA markets too poses risk, though we do not anticipate a very deep correction

Now that the markets have corrected around 11% from their peaks in October, we do see some value emerging in certain sectors and pockets. At lower levels we are constructive on the markets from the medium to longer term perspective, as there are several positive factors in the reckoning, that will be good for the economy – (1) Low interest rate environment that supports consumption (2) Well capitalized and stronger banks that are in good position to meet the credit requirements of the economy, (3) Significant growth rerating of IT services as well as real estate sector which will feed into all other segments of the economy (4) China Plus one factor as well as PLI scheme that will support investments in manufacturing, (5) Revival of CAPEX cycle as the economy fires on all cylinder indicated by GST collection in November, ‘21 (6) A vibrant start up eco system (7) Beneficial impact of several structural reforms that have been implemented such as GST, lower corporate taxation, JAM trinity etc,

We are using the ongoing correction to add to Banking, Pharma & PSU sectors. We are in process of increasing our equity allocation to 50% from the existing 30%. As the market falls more, we plan to add more of Equity, including to IT sector at NIFTY IT index of 34,500.

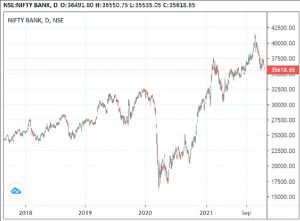

Banking & Financial Services attractive at Bank Nifty Index of 34,400!

NIFTY bank Index has been under severe pressure in the recent market correction as FII selling has been concentrated in Bank and Financial services stocks.

This segment has in-fact under-performed the market over the last two years, which is evidenced in the fact that the price performance of this index from 32,000 to 34,400, has been rather muted as compared to NIFTY move from 12,000 to 16,600.

With the economy firing on all cylinders, credit growth which has been sluggish for a long time, is soon expected to pick up. Banks are well prepared to participate in this expansion cycle, as they have not only restructured their bad loans but have also adequately recapitalized their balance sheets too in the recent years.

As the economy revives, lower credit cost will be further boost to their profitability.

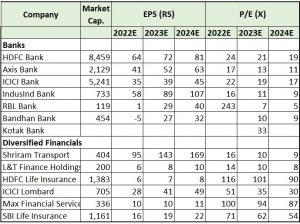

Banking & Financial Services – Sub Segments

Private sector Retail Banks – We are buyers of the high-quality private sector banks such as Kotak & HDFC as they trade at extremely attractive valuations. For instance, HDFC Bank which consistently grows its profits at over 22 to 25% range, has one year forward multiple of merely 20.

Corporate Banks – We remain buyers of the high-quality corporate focused banks such as ICICI, Axis, and SBI. They have not only provided for the bad loans but as sectors such as steel revive, they will be in a position to write back bad loan provisions, leading to bumper gains in profits in the coming quarters.

NBFC Segment – While this segment is froth with risks, they trade at extremely attractive valuations. As they have leveraged balance sheet, they are best positioned to participate in the growth cycle as the economy starts firing on all cylinders. We like NBFC’s with high quality promoters such as L&T Finance, Mahindra & Mahindra Finance & Cholamandalam Finance.

Insurance Segment – Both Life & General Insurance are very under-penetrated segments and will see good growth in coming years. However, we do see risk in savings products that life insurance companies sell, if tax arbitrage is taken away. What happened to ULIP’s recently is still fresh in our minds.

We are under-weight Life Insurance segment not only because of the higher multiples but also because of risk highlighted above.

Asset Management Companies– This segment too is hugely under penetrated. This can be seen from the fact that Mutual Fund companies manage assets that constitute merely 8% of GDP in India. In the developed world this number is closer to 70%. However, most AMC’s other than UTI trade at expensive valuations. With the launch of new funds both domestic and international, we expect more participation in this sector.

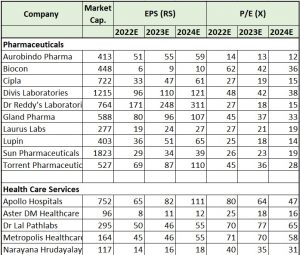

Pharma sector attractive medium at NIFTY pharma index 13,200!

As has been elucidated in our note on Pharma Sector published on December 14, 2021, we have a significant overweight call on this sector. Nifty Pharma index at 13,200, offers attractive investment proposition, from the medium to long term perspective.

After the sharp initial Covid run up, the price action for pharma companies have remained relatively muted. This recent underperformance is due to the pricing pressures seen in the US generics business as well as on the input side, in API’s sourced from China. However, both these factors are expected to abate over the next two quarters, providing the trigger in the shorter term.

As regards the medium/longer term perspective, besides the consistently growing, highly profitable domestic branded generics business, we see significant growth triggers coming from the Complex Generics space in the USA, as well as the growth opportunities for US FDA approved drugs in Rest of the world markets:

- Complex generics (injectables, inhalers, nasal drops etc.,) – While Indian companies are well positioned to open up this space (USD 25 Billion), they have yet to gain full traction. Companies like Cipla, Sun, Aurobindo, Gland Pharma etc., are well positioned in this space.

- Rest of the world – We are best positioned to monetize the US FDA approved drugs in rest of the world markets and thereby become pharmacy capital of the world. This will be one of key growth drivers in coming years.

- Bio Similar – Multiple block buster (multi-billion Dollar) biologic drugs are going off patent in the coming years. This area will offer interesting growth possibilities, If interchangeability norms are implemented by US FDA and European Medicine Agency.

IT Services: Attractive Opportunity at NIFTY IT Index of 35,000!

Driven by significant revision of growth numbers, Indian IT services companies, have had a remarkable run from NIFTY IT index level of 15,000 just two years ago to 36,500 now.

Despite the spectacular run up, IT services companies on aggregate are nowhere near overvaluation region.

Rerating has happened as companies are growing at a much faster pace of over 15% now as compared to pre pandemic rate of 7-8%. The higher growth is expected to sustain over the medium term.

It is interesting to note that Accenture has recently revised its growth guidance from 12 to 15% range to 19 – 22% range for FY 22.

What are the sector dynamics in terms of growth and cost?

Out of the total IT services market of USD 2 trillion, IT outsourcing component amounts to USD 900 Billion. Indian IT services companies, including group captives address 180 billion USD, which amounts to 20% share of the total outsourcing market.

Indian IT services companies are witnessing accelerated growth due to:

- Market share gains – PANDEMIC experience has taught us that more work can be delivered remotely, which makes the value proposition of Indian companies even stronger, leading to market share gains for them.

- Accelerated growth in global IT services Market – IT services market, which used to grow at 3% in past is now growing at 8% as per a recent Gartner’s report. While this growth may dip somewhat, we expect that it will at a rate higher than 3% for the next few years.

Improvement in operating margins

As onsite component reduces, not only will travel/H1B visa cost reduce, but also the salary cost for US hires will go down.

At the same time, we are also seeing significant reduction in office rental cost, because of work from home culture that has been precipitated by the PANDEMIC.

However, it may be pertinent to highlight that the sector is witnessing sharp increases in domestic salaries, partially neutralizing the above cost decreases.

What is our take on IT services sector?

While the rerating of IT companies has already taken place, we remain buyers at somewhat lower levels, that is at NIFTY IT index of 34,500. We see more value in large cap IT companies as compared to Mid and small cap ones.

Tactically, we feel that there may be some price correction as growth tapers in coming quarters because of the high base effect. We plan to use any such correction to build position in IT sector.

FMCG at NIFTY FMCG index of 35,500 – Starting to catch attention!

FMCG sector has corrected 15% from the recent peaks.

After a long time HUL is trading at 1 year forward multiple of 46/47. Other FMCG companies with Indian management like Dabur, Marico, Godrej consumer products, Tata Consumer too are trading at relatively attractive 41/43 forward multiples.

Even though the price has come down by 15%, we feel that the valuations are still stretched. For a sector that clocks 6% volume growth, the valuation looks stretched even if one accounts for the fact that the risks associated with FMCG business is very low as their brand, distribution channel etc., are well established, which provides them with a significant moat.

However, keeping in view that these companies have always commanded a premium valuation, we plan to build some exposure in this segment at current levels.

Auto Sector – Valuations under pressure at NIFTY AUTO index of 10,300

Surprisingly, Auto sector’s performance has been very muted, even though it’s a consumption play. 4 wheelers which are relatively under penetrated are expected to grow at 8/9% (volume). 2 wheelers that have greater current penetration, will grow at a lower rate of 6% in volume terms.

However, growth has been exceedingly disappointing as evidenced in the fact that FY 22 volume is 20% below the peaks in FY 19-20:

- This has been due to the sharp increases in prices (30%) due to several factors coming together at the same time – (1) Increase in input costs, (2) Implementation of the new safety norms / emission standards (3) Insurance costs taken upfront.

- The lower sales numbers are also on account of disruption in production due to non-availability of chips.

While valuations are attractive, cheap valuation is because the market is factoring in the imminent Electric Vehicle risk on one hand as well as the poor sales numbers on account of chip shortage/price increase, on the other.

As we expect sales numbers to improve in coming quarters, we are somewhat constructive on the sector at current valuations.

Public Sector companies are excellent Dividend yield Plays

These companies are focused on sectors that are core to the economy and often have dominant position in their area of business. Most PSU companies offer 5 to 6% dividend yields providing an interesting, fixed income play in the current low interest rate regime. We do recommend adding some exposure to this segment at lower levels.

Our segment wise take on PSU/PSE companies is outlined below:

- Upstream OIL (ONGC/OIL): At earnings multiple of 7, both these companies trade at very attractive valuation. Valuation is attractive even if one accounts for the fact that after 10/15 years Electric Vehicles may lead to significant slowdown/decline in oil consumption.

- Refineries (IOC, BPCL, HPCL): At Earning multiple of less than 10, these are very attractively priced. Oil marketing business is protected by a natural moat. Though in the longer run margin pressure may be witnessed in view of EV’s.

- GAS Value Chain (GAIL, Petronet LNG, MGL/Indraprastha Gas): Companies in GAS value chain will benefit from following GAS demand going up in the coming years: (1) Emphasis on cleaner fuels will lead to higher demand for CNG (2) Piped Natural Gas will increasingly replace LPG as cooking medium (3) As renewables gets integrated into GRID, there will be greater need for adding Gas based power plants to enable GRID stability

- Power (NTPC): Downside is protected as it has all cost plus PPA arrangements. Further, it has opportunity to acquire assets cheap in the NCLT process as well.

- Defence Equipment’s, Aeronautics, Shipbuilding (Bharat Electronics, Hindustan Aeronautics, Garden Reach Shipbuilders): Increasing Demand for modernizing defence equipment as well as focus on make in India, will keep their order books healthy and growing.

As compared to buying stocks directly, Mutual Funds are a better route for taking exposure to this segment as they bring tax efficiency, since dividend is taxed at a higher rate as compared to Capital Gains.