Pharma Sector : Attractive Medium to Long Term Opportunity !

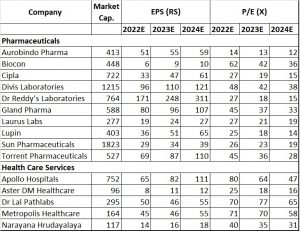

Pharma Sector at Nifty Pharma index of 13,200, offers attractive investment proposition, from medium to long term perspective.

After the sharp initial Covid run up, the price action for pharma companies have remained relatively muted. The underperformance is due to the pricing pressures seen in the US generics business as well as on the input side in API’s sourced from China. However, both these factors are expected to abate over the next two quarters, providing the trigger in the shorter term.

After the sharp initial Covid run up, the price action for pharma companies have remained relatively muted. The underperformance is due to the pricing pressures seen in the US generics business as well as on the input side in API’s sourced from China. However, both these factors are expected to abate over the next two quarters, providing the trigger in the shorter term.

As regards the medium/longer term perspective, we see growth triggers coming from (1) Complex Generics space in the USA market (2) building further onto the traction obtained in the rest of the world market. At the same time, India business, will continue to remain not only profitable but will keep growing at 7/8 % (volume).

We recommend overweight position in pharma sector from the medium to long term perspective, because of the above growth kickers.

An analysis of what could be possible growth drivers for Indian Pharma Companies in the coming years:

- India business (branded generics) will continue to be the key driver of valuation for the Indian Pharma companies. They will not only continue to see healthy EBIDTA levels (30%) going forward, but also witness robust volume growth of over 7/8%. In our opinion, we see little risk to 35 multiples that India business commands.

- US simple Generics – We don’t see much upside in the simple generics space, as this has turned into a commodity business and fiercely competitive as well. At the same time growth too will be limited, as we have already gained significant market share.

- Complex generics (injectables, inhalers, nasal drops etc.,) offers attractive growth opportunity, with market estimated at USD 25 Billion. While Indian companies are well positioned to open up this space, they have yet to gain full traction. Companies like Cipla, Sun, Aurobindo, Gland Pharma etc., are well positioned in this space.

- Biosimilars – While, it offers exciting growth possibilities, with block buster (multi-billion dollars) biologic drugs going off patent over the coming years, this segment faces many challenges. The FDA approval process is far more involved, as Biosimilar is not exactly identical to the original molecule. Further, not being identical means establishing interchangeability is a far more involved process. Commercialization not only requires significant investment in R&D for developing the molecule, it also requires investment in building a sales force in absence of interchangeability standards. While, Biocon has three molecules that are approved by the authorities in USA and Europe, they have not yet gained market share traction in absence of interchangeability norms. We will wait for these norms to be implemented before we bet for this segment.

- Specialty Segment – While Sun Pharma has gained traction in this space, we will not bet for success of any other pharma companies in this segment. This is because of the large investments required not only in drug development but also in setting up the sales force.

Sun Pharma’s model has been to acquire molecules at early stage from start-up companies and to then invest in getting the phase 2 and phase 3 approvals. At the same time, they have made significant investments over the past 5 years in building sales force in the field of Dermatology, Oncology and Ophthalmology. Our assessment is that Sun pharma stands a 50% chance of achieving success in this space. As clarity emerges, Sun can be an excellent investment bet.

- Rest of the World – The Indian pharma companies are best positioned to monetize the US FDA approved drugs in rest of the world and thereby becoming the pharmacy capital of the world. This area will be one of the growth drivers in coming years.

To recapitulate, we see growth kickers coming from

(1) India business

(2) Complex Generics space in USA

(3) Rest of the world markets for drugs that are US FDA approved

Biosimilars will be the wild card and success will be dependent on implementation of interchangeability norms.