Indian IT Services Sector – How to negotiate the market

In the post PANDEMIC era, Indian IT services companies are on an accelerated growth path and seem set for a mega growth decade propped by myriad drivers.

- Not only is the technology services pie growing much faster now, as several mega trends unfold – Cloud, Metaverse, AI/ ML, IOT, accelerated

digital transformation etc,

- But also, the Indian companies will continue to gain market share, because of their increased cost competitiveness as the realization

dawns (drawing from the PANDEMIC experience), that it is now possible to deliver more work from remote location.

The above is corroborated by NASCOM’s forecast, that this industry will grow from USD 227 billion in FY-22 to USD 350 billion by FY-26. (CAGR 12%). The recent growth guidance of 24 to 26% for the current year from Accenture, one of their largest global peers, further reinforces the fact that demand remains robust.

This also shows up in the stellar growth numbers (constant currency) that Indian IT companies have already announced or will be announcing for Fy 22: TCS – 15.4%; Infosys- 19.3%; Wipro – 27%; Tech Mahindra – 17%; HCL Tech – 13.2%; LT Info – 26.8%, Mindtree – 31.2%, Mphasis – 21.7%, LT Tech services – 19.6%;

In our opinion double-digit growth rates will sustain for some-time. Also, the availability of a large manpower pool in India, implies wage pressure will be moderate in the longer run. The impact of this on margin will be minimal, as the higher demand environment will ensure that any wage increase can be passed on to the client.

However, margin may be under pressure in the short run, due to several factors such as large numbers of fresh recruits who are still under training, attrition issue, wage inflation, travel cost reversion etc., This situation is expected to soon improve as contracts are renegotiated at higher rates and as the utilisation rate improves, with the under-training manpower being deployed on projects.

Any sell-off, due to current margin pressure will be a buying opportunity!

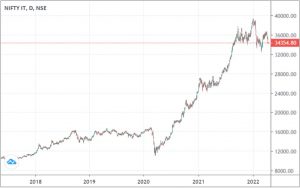

The sector has seen significant rerating of multiple from 15 – 17, just two years ago, to 30 to 32 now. The current valuation assumes a growth forecast of 12.5% to 13% for the next 3½ to 4 years for large cap companies (and even higher growth for mid cap ones) and thereafter reverting to 8/9%.

However, since we expect the double-digit growth rates to sustain for longer as compared to what is baked into current valuations, we are constructive on the sector, though we feel that there is little room for error at current levels.

However, we do see good buying opportunity emerge, if NIFTY IT index drifts to levels of 32,500 due to margin pressures.

What is our outlook for demand in the longer-term?

- Several technology mega trends will support sustained double digit growth.

- Cloud will continue to grow at CAGR of 25 to 30%, driven by video streaming, gaming, storage, Enterprise migration to cloud. The key will be to partner major cloud service providers (AWS, Microsoft Azure, Google cloud etc…,).

- Accelerated pace of digital transformation precipitated by PANDEMIC is a multiyear trend.

- Metaverse expected to contribute upto 10% of total IT services market by 2026.

- Some other high growth areas include IOT, Smart homes, smart factories, robotics, AI/ML.

Market share gains will further boost growth of Indian IT services companies

- As Indian IT services companies still have only 22% of the market share of the USD 1 trillion technology services market globally, there is room for them to further grow their market share

- There has been a realization during the PANDEMIC, that more of the work can be delivered from remote. Hence clients may not insist for too many onsite personnel going forward. This clearly puts Indian IT services companies at an advantage over their global counterparts, enabling market share gains

What is our outlook on margin in the longer term?

Currently 5 million people are employed in this sector. In-order to cater to 13-15% growth, IT services companies will have to add 6 to 7 lacs people to this pool annually.

The supply of trained manpower can be easily expanded to cater to the above numbers, because of the large population base that we have. Besides the engineering pool of a million every year, there is a big pool of students from science & commerce background, who can be trained in IT skills. As such, we do not see the availability of talent pool, constraining the growth.

However, it needs to be noted that the policy makers need to act in time, to build adequate capacity to train students in skills, such as cloud, metaverse, AI/ML, Digital technologies etc, by allocating more seats to such areas, in our engineering colleges as well as vocational training institutes