US Tech Sector – Outlook

The key to how the US Tech Sector shapes up in the coming months, will depend on how the FED manages the red-hot economy as well as how the inflation situation pans out. The course that the markets take, will also be decided by the results as well as guidance from Mega Techs later this week.

A. How the economy & inflation Pans out over next 6/12 months – Different Scenarios

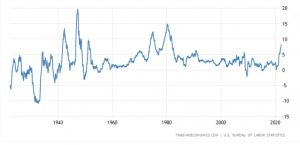

a) FED manages to soft land the economy – Markets will bounce sharply, if the FED is able to tame inflation, without pushing the economy into a recession. Gradually reducing inflation print now onwards will be an important indicator pointing towards this outcome. (i.e., 8.5% CPI number last month turns out to be the peak). As inflation eases, it will give FED, room to be less hawkish. In this context, it will be interesting to keep track of inflation numbers that are to be announced in the second week of May

b) Economy gets into a recession for one or two quarters, however, inflation is tamed soon thereafter giving FED the room to ease – The selloff in this instance, will be very limited from the current levels and markets will eventually bounce. The key number to watch again is inflation and how it behaves

c) The difficult situation will be, if the economy goes into a recession and yet inflation remains high – This can happen, if inflationary expectation has got entrenched in people’s psyche and will definitely be a problematic case to deal with. In such an eventuality, NASDAQ could easily come down another 10%. It will be interesting to recall, 1980’s and the fact that tight monetary policy was required for an extended period of time (Paul Volcker’s regime) to squeeze out inflation.

B. Results & guidance from Mega Techs this week will also decide course of markets

The Mega Techs are likely to announce some slowdown in their growth guidance. Not only in anticipation of the slowing economy, but also as the PANDEMIC effect rewinds.

a) Growth guidance from Google poses some risk as advertisement, which is the main driver of its revenue is sensitive to recession

b) Microsoft and Amazon will benefit from the strong growth trends in cloud

c) However, some slowdown in other businesses of Microsoft is expected, as people buy fewer lap tops and desktops

d) While, Amazon may have some challenges on streaming services, e commerce segment is expected to hold up well

e) Apple – 5G will continue to drive demand for mobiles as everyone will have to soon upgrade their mobile phones. Hence the slower economy may have limited impact on its outlook

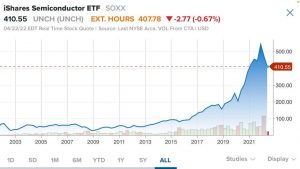

Valuation outlook for Semiconductor

Though this segment is sensitive to recession, I guess the sharp sell off this month, already accounts for majority of the pain.

Blackrock’s semi-conductor ETF is down from 550 to 400 levels over the last 4/5 months. (27% lower)

As the world becomes increasingly semiconductor intensive, lower levels will offer good buying opportunity

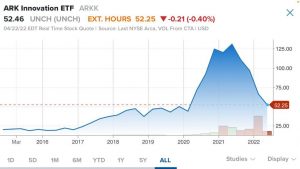

Valuation outlook for Software, SAAS, Consumer internet companies

Most such companies are already down 60 to 70% in last nine months. Ark innovation fund, which is a good reflection of this segment is down from 130 to 50 over the last 9 months. (i.e., 60%). As such we see limited downside from hereon (maybe 10%)

How should we negotiate the market?

We do not think that the third case (economy slides into recession and yet high inflation persists) is the central case. While FED has delayed, things have not yet got out of hand.

In fact, we do not ascribe more than 20% odds to this.

It will also be pertinent to keep in mind, the exciting long term growth opportunities in the disruption and innovation space. There are several mega trends in place as the world becomes more technology intensive – Semiconductors, Metaverse, Fintech, AI & ML, Robotics, Clean energy, Electric Vehicles, Bio Tech. The list goes on ….

As such, from the risk reward perspective, we advocate to gradually start building exposure in US Tech segment at 5% lower NASDAQ levels.

The note of caution is that there can be some more pain in the short term, but it’s difficult to time the exact bottom. If we wait too long, we can miss the long-term growth opportunity in this exciting space.