US Tech Sector – Outlook

NASDAQ Composite index is trading 7.5% below its recent peak.

The mega caps as well as the semiconductor stocks have held up extremely well and this has supported the index level, though there has been a sharp selloff in many of the mid/small cap segment.

- Most mega cap stocks have excellent cash flows and as such are not very sensitive to interest rates.

- As regards the semiconductor segment, it is supported by very strong fundamentals, as is outlined later in this note.

However, as interest rate has risen, the selloff in, in the broader tech sector, has been very sharp indeed. It will be pertinent to note that earnings for most Tech companies is typically far out in the future and hance their NPV is very sensitive to rising rates.

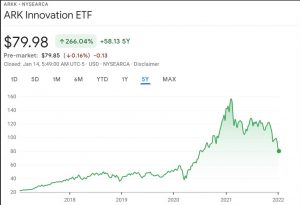

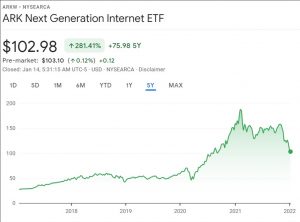

In the above context, we draw attention to two of Cathy Wood’s managed ARK ETFs (ARK Innovation, ARK Next Generation Internet). They are down between 42 to 45% from their respective peaks just a year ago, illustrating the distress that exists in the broader mid/small cap segments. Refer Charts on this page.

Inflation numbers for December came at 7%. Fed will not only have to raise rates, but also contract their balance sheet.

What is our take ?

1) Broader Innovation/Disruption Theme

We feel that as interest rates rise, this downward trend in the broader market may continue for some more time, despite the already lower levels, after the sharp sell off.

However, good buying opportunity will emerge at lower levels as investing in disruption/innovation has always been a rewarding experience in the longer term.

We recommend entry at 7-8% lower level.

2) Semiconductor Theme

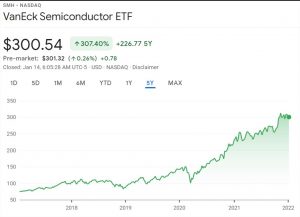

It is interesting to note that semiconductor segment has held up remarkably well.

The semiconductor industry has witnessed around 15.8% CAGR over last two years (FY 20 to FY 21), an outcome of several trends that were precipitated by global lockdowns such as Work from home, people spending more time on laptops and mobile phones, accelerated digital transformation etc,

This is reflected in their stock prices that went up sharply, during the last two years. (Refer Chart)

The growth momentum in semiconductors, is expected to sustain even though it is on a significantly higher base. We expect the momentum to continue, driven by several factors such as 5G, Electric & driverless vehicle, Metaverse, Smart homes, Smart factories, IOT, Artificial Intelligence, HPC, Video streaming, Gaming etc.,

We recommend investing in this segment at 8 to 10% lower levels.

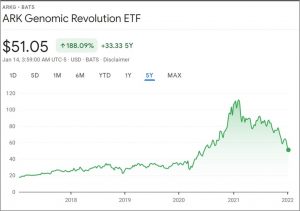

3) Biotechnology/Genomic Theme

There has been significant advancement in several therapies, cellular as well as gene-based ones in recent years:

- Gene sequencing along with Gene editing techniques, for finding cure to mono genic disorders as well as several other applications

- Bio Informatics correlating specific DNA sequence to various disease propensity

- Leveraging immune system for various therapies such as finding cure for Cancer (CART cell technique)

- Various applications of Stem cell research

Several therapies for cancer, Alzheimer, Mono Genic diseases etc, are in advanced stages of clinical trials (phase 1, Phase 2). Cost too is dropping sharply, for instance Gene Sequencing.

We expect waves of demand for such therapies to emerge, due to convergence of factors outlined above.

We recommend building exposure at 5-7% lower levels.