Our Sectorwise Take

May 26, 2020

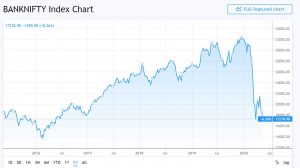

Banking & Financial Services

We are buyers at NIFTY Bank index of 17,000 – 17,500, though the consensus opinion is otherwise.

Our optimism arises, as we expect lower mortality rates leading to faster restoration of normalcy. As the market is pricing a grimmer outlook for COVID -19, it expects significant deterioration in Asset Quality. Since Banks / NBFC’s are highly leveraged (8 to 10 times from Debt / Equity ratio), it is not surprising that Nifty Bank Index has fallen from 32,500 to 17000. A drop of 46% since Mid-March.

However, we recommend investments in the strongest/highest quality Banks & NBFC’s as these, offer good risk adjusted returns. Their better credit processes will help them with lower loan loss provisions. At the same time, their brand will help them avoid any run on their money. As weaker companies struggle, they will gain market share as well.

Banking Segment – We are buyers of the high-quality banks such as Kotak, HDFC twins, ICICI, Bajaj Finance & SBI.

NBFC Segment – We plan to avoid this segment (other than Bajaj Fin / HDFC), even though fall in stocks has been stark (over 60%). If COVID situation worsens, many such companies will struggle to keep afloat. Credit markets are worried too. The spread between PSU (AAA) and AAA/AA papers of NBFC’s is 400 bps. Historically high levels!

Insurance Segment – Both Life & General Insurance are under-penetrated segments. Further, Health Insurance may see increased demand in view of COVID 19. While, prospects look good, valuation is expensive. We intend to build position only on sell off.

Asset Management Companies– This segment is hugely under penetrated too. For instance, while AMC’s constitute merely 8% of GDP in India, they are 70 to 80% in developed markets. However due to expensive valuation, will buy only on sell off.

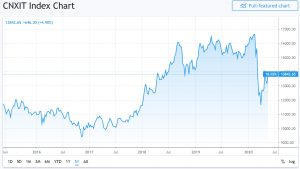

IT Services Companies

We remain buyer of this sector at somewhat lower levels (5/6%). NIFTY IT Index of 12,500.

We see significant gains in the medium to long term, both for IT services as well as Telecom sector because of significant behavioral changes arising from COVID 19.

We see a greater push all over the globe towards

(1) remote working

(2) Remote delivery of physical goods as well as content

(3) Online education

(4) Digitization for improving productivity.

We also believe that the Indian IT services companies will further gain as it will be soon realized that more on site/near shore component can be done from offshore. The telecom companies too will gain from all of the above trends as all of these will need to be delivered over the telecom infrastructure.

IT services companies are trading at relatively undemanding valuations with TCS at 22, Infosys at 18, HCL at 15, Wipro at 12.5. (based on trailing PEs)

FMCG Sector

This segment will not be much impacted by COVID 19. However, we will continue to avoid this segment in view of the high valuations. Though there may be merits in some of the individual stocks like ITC that is aggressively diversifying into non cigarette category.

Auto Sector

We are neutral on Auto Sector

- We are likely to see spurt in two-wheeler sales, as people will be fearful of using public transport

- The Passanger Vehicle segment will see sluggish sales, as people will like to postpone big ticket sales. However, there will be some demand for mass market cars from OLA/UBER users who may want to shift to their own cars.

- As GDP struggles, we do see pains to continue in the commercial vehicle segment for one more year

- Tractor segment will not be impacted as COVID 19 does not affect agriculture

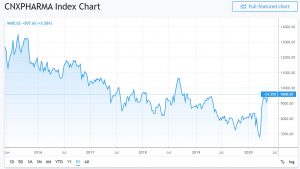

Pharma Sector

This had been one of our massive overweight positions till recently which worked exceedingly well for us. We have used the recent 35% rally to reduce our allocation from 30% of equity weight to 15% now.

While there has been significant valuation catch up, the relative valuation remains attractive.

- Neither the domestic nor the export business is significantly impacted by COVID 19

- The domestic business is a highly profitable business with consistent growth

- As regards US Generics business after 3/4 years, the prices are starting to stabilize

- Indian companies are establishing their foothold in specialty/bio-similar segment

- API business (some part) to shift from China as people look to diversify supply chains

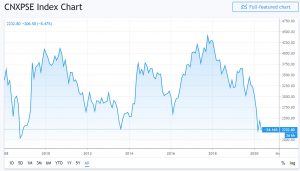

PSU segment

We are bullish on this segment. With dividend yield generally around 7% and earning multiple well below 10, the risk rewards in this segment remains extremely favorable. Further, these companies are focused on core sectors of the economy and often have dominant position in their area of business as well.

Valuation has been subdued, because Govt. has been selling stake at discount through the ETF route. Valuation of NIFTY PSU Index is more than 50% below its long-term average. The spread of Earning Multiple, with respect to the private sector peers is at a historic high. We see strategic divestment as a significant re-rating trigger. Strategic divestment will not only help Govt. mobilizes funds for stimulating the economy, but also help it to boost the efficiencies/productivity levels in the economy.

Rajesh Prasad +91 9819006666

Satish Mishra +91 9324904306