Navigating The Choppy Equity Markets

May 26, 2020

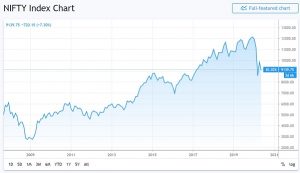

We are somewhat positive about Indian Equity markets at current levels. (NIFTY 9,000).

Summary of our Investment Strategy:

- While, we do not expect a V shaped spring back, we do feel that recovery will not be very prolonged either.

- We also believe that the earlier lows, made in March 2020 (NIFTY 7,500 levels) will not be revisited or breached.

- We expect the market to be range bound for next 6/9 months and trade between 8,300 to 10,300 range.

- We feel that NIFTY will climb back to 11,800-12,000 levels by Dec 2021, as we expect the GDP in FY 22 to spring back to FY 20 levels

- While our current equity allocation is 60%, we plan to increase it to 75%, if market falls to 8400/8500 Nifty levels.

We expect markets to be choppy for 6/9 months:

- There are bound to be mood swings in the coming days. On one hand the news flow on the economic front will be dismal. On the other, as the number of test ramps up, infected numbers will keep growing. The earning numbers will hugely disappoint as well.

- In our central case forecast, we expect the US markets to come down by 10 to 15% from the current level (S&P at 2,975). This too will act as a drag.

Factors that will shape the economy as well as the stock markets in coming days:

- With respect to COVID 19

- What is mortality rate in India? Low mortality may drive, faster recovery

- As we open up our economy, what steps are being taken (1) towards social distancing (2) testing and contact tracing

- How fast the medical solution comes

- How do we take advantage of manufacturing moving out of China?

- What is the monetary/fiscal stimulus that the Govt has rolled out as well as measures that have been taken towards preventing bankruptcies?

What is our take on mortality rate in India?

We expect mortality rates to be capped in the range of 0.1% to 0.2%, a number far lower than most estimates available currently. We are hazarding a guess on this, even though there is no formal study – a study that ascertains % of population that is infected would have been very useful.

We arrive at our estimate of mortality rate in a roundabout manner from several anecdotal evidence:

- Certain Observations in India on spread of COVID 19

- Maharashtra: Test positivity rate avg over 15% recently, against 1700 deaths

- At Arthur Road jail, 45% of 350 people that were tested were found infected

- 8 to 20% of the migrants returning to UP/Bihar have been found to be infected

- Recent study done abroad

- Stanford University study in California indicates mortality in 0.1/0.2% range

- New York State (study a month ago) ascertained that 14% of population was infected with about 20,000 deaths and 20 million population

- Center for disease control % prevention (USA) has estimated COVID 19 death rate at 0.26%. Younger demography. means lower mortality rate in India

Govt Stimulus Package – Our Assessment

There has been an unprecedented level of fiscal and monetary stimulus that has been provided in USA and to somewhat lesser degree, in rest of the developed world.

However, in India the Govt. has come in for some criticism since the quantum of fiscal stimulus has been tepid. In this regard, we must understand that the Govt loan to GDP ratio currently stands at 70%. This ratio will further climb to 80%, by the year end, as the combined deficit for Centre & State is estimated at 10%. A level that will surely attract attention of rating agencies!

However, we do feel that the Govt could have deployed certain additional firepower by allocating more to the infrastructure space. This would have helped not only to de-bottleneck the supply side of the economy but would have provided jobs to thousands of construction workers as well.

As regards Monetary Stimulus, our take is that, RBI has been reasonably aggressive on this front. REPO rate has been brought down to 4% and reverse REPO at 3.35%. At the same time, the banking system is flooded with excess liquidity of Rs 7 lac Cr. Not only this, under the TLTRO, banks have been provided with cheap credit for investing into corporate bonds. Periodically, RBI has been intervening in G-Sec market through OMO, to bring down yield across the curve.

It is also our take that Govt. has taken adequate steps, to reduce structural damage to the economy by supporting MSME, NBFC’s with the aim to prevent bankruptcies –

(1) Rs 3.0 lac Cr loan support to MSME

(2) Liquidity support for NBFC’s/Hsg Fin Companies.

To Recapitulate

Our central case forecast for the economy is that it will contract by 7 to 8% in FY 21, a forecast far worse than almost all others. However, we believe that the early lifting of the lockdown restriction, though in a phased manner, will prevent the economy from suffering extensive structural damage and create the platform for a sharper revival. Of-course, the devil lies in detail. It will be important for the Govt. to not only come out with the right guidelines regarding social distancing norms but enforce it too. Success on Testing and contract tracing front will be critical too.

It is important to note that, we do not expect a serious backlash from COVID 19 in the form of second wave, primarily as we believe that mortality rate is low.

We are also conscious of the fact that a sudden upside may come from a medical solution. There are several companies making progress on the vaccine front such as Oxford / Moderna and many others as well. Hence, we are not very underweight the market as we don’t want to miss the upside.

Satish Mishra +91 9324904306

Rajesh Prasad +91 9819006666

Sector-wise take – Please click on the icon below to see our latest sector-wise analysis