Wealthspring Sectoral Overweight’s – Significant Outperformance

Earlier this year, our pharma sector call had worked exceptionally well.

Earlier this year, our pharma sector call had worked exceptionally well.

Happy to share that our Public Sector Enterprise (PSE) call is now working equally well.

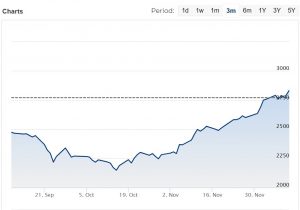

NIFTY PSE index has moved up from 2200 to 2850 in last two months. That is a gain of over 30%.

We had strongly recommended PSE sector funds in our advisory note published on Dec 9, 2019 and then reiterated the same view again on 13th April 2020.

We had gradually built the PSE exposure for our customers to 35% of their respective equity portfolio. Our customers have experienced excellent returns in IRR terms, despite our total equity allocation being moderate, because of the significantly high PSE overweight.

Since our returns have come with half the portfolio in Debt, portfolio risk has been minimal as compared to a pure equity portfolio.

As such, from “Risk Adjusted Returns” perspective our average customer return works out as even more attractive.

Contact – satish.mishra@wealthspring.in OR rajesh.prasad@wealthspring.in